- About Us

- Search

- Need Help?

- Donate

- Login/Register

Latest Entries

Actions Menu

Blog Roll

- 4F Facebook Page

- Turn Up The Night with Kenny Pick

- Stephanie Miller Show

- The Tim Corrimal Show

- The Rachel Maddow Show

- Angry Americans with Paul Rieckhoff

- Thom Hartmann Program

- Turnips! Fans of Turn Up the Night Facebook Page

- Snopes.com

- Factcheck.org

- Official White House Page, if you must.

- The Brad Blog / Green News Report

- The Poorly Written Political Blog (Joe Santorsa)

How about that recovery?

Author: TriSec

Date: 01/09/2010 12:29:58

Good Morning.

Well, the job figures are out for December, and they're not quite what the President had in mind. After November, a lot of us were hopeful that maybe things would be a wee bit better this past month. Alas, It was not to be.

Jobs are but a small part of any recovery, but perhaps the most visible and important of them all. But there's so much going on behind the scenes right now, it's almost impossible to comprehend what might happen, or what the government might do to make things happen.

What might be next in 2010? Glen Allport of "Strike the Root" has written an interesting and scary column full of jaw-dropping graphs that's worth the time for you to check out.

But that's not the chart that does it for me. Remember the housing crisis? Foreclosures, and all that good stuff? That was just the tip of the iceberg. Thanks to GWB's 'ownership society', and the willingness of every bank in America to resort to "Klingon Math" in order to get people into mortgages they couldn't afford, we're on the brink of an ARM crisis unless something changes.

Of all the things I read last night and today, perhaps this animated chart brings it home the hardest. It's the jobless rates by county over time dating back to January of 2007.

President Obama has taken the merest of baby steps on getting things back to right. He said it yesterday; sometimes we take a tumble on the road to recovery...here's hoping we get right back up and keep walking forward instead of lying in the ditch wating for the bus to hit us again.

Well, the job figures are out for December, and they're not quite what the President had in mind. After November, a lot of us were hopeful that maybe things would be a wee bit better this past month. Alas, It was not to be.

The nation can expect sluggish job growth and high unemployment in coming months as tight credit, long-term joblessness, and cautious spending by consumers and businesses weigh on the economic recovery, Eric Rosengren, president of the Federal Reserve Bank of Boston, said yesterday.

Rosengren, addressing the Connecticut Business and Industry Association in Hartford, made his remarks shortly after the Labor Department reported that US employers cut 85,000 jobs in December and that more than 600,000 unemployed Americans stopped looking for work. That helped keep the nation’s jobless rate steady at 10 percent, since only those who actively seek work are counted by the Labor Department as unemployed.

The December employment report was a setback to hopes that the national labor market had hit bottom and job growth would resume. Analysts said it was particularly disappointing following November, when the nation added 4,000 jobs - the first job growth in nearly two years, according to revised statistics released yesterday.

“I was hoping for a positive number in December and a new spin on the shape of the recovery,’’ said Bill Cheney, chief economist at John Hancock Financial in Boston. “In the end, we’re left just about where we were before: All the pieces are in place for the job market to turn around, but it hasn’t done so yet.’’

In Washington, President Obama also expressed disappointment as he announced the award of $2.3 billion in stimulus tax credits to alternative energy firms.

“The jobs numbers that were released by the Labor Department this morning are a reminder that the road to recovery is never straight, and that we have to continue to work every single day to get our economy moving again,’’ Obama said. “What this underscores, though, is that we have to continue to explore every avenue to accelerate the return to hiring.’’

In his remarks, Rosengren said the economy and labor markets still have to work through the lingering effects of the worst recession since the Great Depression. The situation is vastly improved from a year ago, when credit froze, financial markets spun into free fall, and the nation shed some 700,000 jobs a month, Rosengren said. Still, banks continue to lend cautiously; consumer spending is still constrained; and businesses remain reluctant to hire.

“It appears that this recovery will likely experience only a slow improvement and the unemployment rate will remain quite elevated during the early phases of the recovery,’’ Rosengren said.

Economic growth, he added, “will be enough to produce some employment growth, but the rate of employment expansion will not likely be rapid enough to put a large dent in the unemployment rate.’’

Jobs remain the missing ingredient in an economic recovery that many economists believe began at the end of the summer. In terms of production, the US economy grew at a moderate rate in the third quarter of last year, and most analysts expect that production expanded faster in the fourth...

Jobs are but a small part of any recovery, but perhaps the most visible and important of them all. But there's so much going on behind the scenes right now, it's almost impossible to comprehend what might happen, or what the government might do to make things happen.

What might be next in 2010? Glen Allport of "Strike the Root" has written an interesting and scary column full of jaw-dropping graphs that's worth the time for you to check out.

I wrote the first of these "Year Ahead" columns two years ago because I expected the coming collapse (described earlier in Destruction by Paradigm, March 2007) to begin in earnest during 2008. I saw epic debt levels, massive monetary inflation (not just in the U.S. but on a global scale for the first time in history), resource depletion (especially for oil, metals, and fresh water), government encroachment into almost every area of life, growing levels of corruption in and out of government, pollution of both freshwater sources and the oceans, and a host of other problems coalescing into an unprecedented storm – a dark tipping point poised to bring poverty, tyranny, hunger, and homelessness to millions of formerly middle class families. Just saying that out loud sounds extreme – things couldn't get that bad, could they? – but in fact that much has already happened and the storm has just begun.

Both the mainstream media (including their favored "experts" and commentators) and the general public saw things differently two years ago – and still do. Businessweek ran a story on December 29, 2009 titled U.S. Economy: Confidence Rises as Consumers See Brighter Future, which suggests (to me) that the combination of reinflation by the Fed (i.e., massive monetary creation) and its immediate effects – partial reinflation of stock prices and a slowing (in some places, a slight reversal) of the ongoing real estate crash – plus the constant assertion in the media that the worst is over – have worked their magic. Americans don't see the job picture improving much anytime soon (and they're right), but they have more confidence than they did a few months ago.

The Frankenstein Economy

That will change in the coming year, as the Frankenstein economy – long-dead but artificially reanimated using bizarre, harmful, and unsustainable means – goes into cardiac arrest. Propaganda, denial, and fiat money creation can only do so much, and as the old world crumbles, it will become ever-harder to sustain the illusion of normalcy.

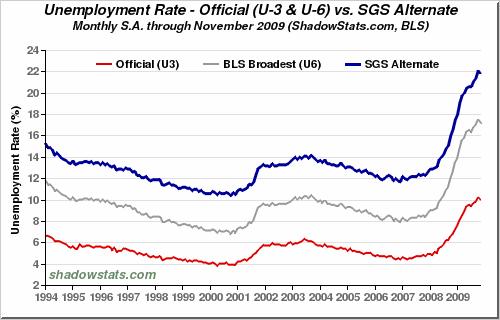

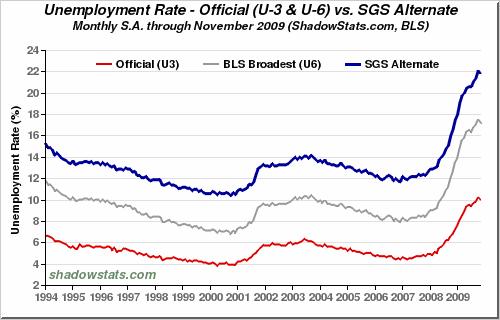

Consider what we've already been through: Roughly $60 trillion in wealth evaporated in 2008 as stocks crashed, real estate prices tumbled, and huge banks and other financial institutions failed (including Lehman Brothers – the largest bankruptcy in history up to that time [edit 1/8/2010: actually, it's STILL the largest] – and the insolvent Bear Stearns, sold to J.P. Morgan for $2/share, down from $172/share in early 2007). A sobering 2.6 million American jobs disappeared in 2008, even using the heavily-massaged official numbers. Shadowstats.com shows a current unemployment rate of 22% versus the official rate of about 10% – see chart below, which also makes clear that unemployment continues to worsen, and very dramatically.

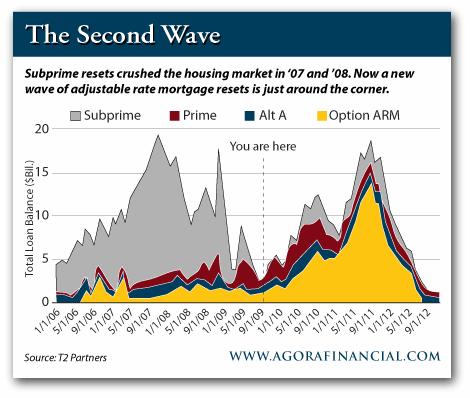

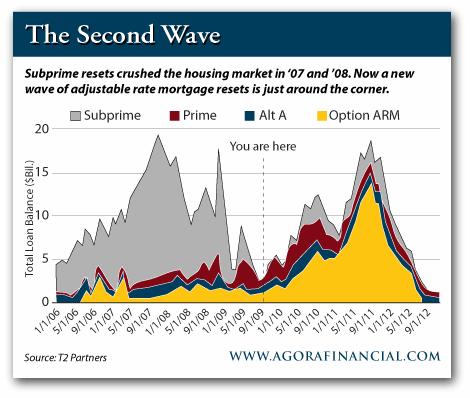

But that's not the chart that does it for me. Remember the housing crisis? Foreclosures, and all that good stuff? That was just the tip of the iceberg. Thanks to GWB's 'ownership society', and the willingness of every bank in America to resort to "Klingon Math" in order to get people into mortgages they couldn't afford, we're on the brink of an ARM crisis unless something changes.

Clearly, the real estate disaster is far from over (and we haven't even mentioned commercial real estate – another looming horror story – or the disappearance of home equity credit lines or the real estate implosion in Dubai, with effects that go far beyond the Middle East). We are merely in the eye of the storm; the next wave of defaults is already locked into place. BusinessWeek has called option ARMs (the massive tan-colored lump underlying the spike on the right side of the graph) "Nightmare Mortgages" and says "The option adjustable rate mortgage (ARM) might be the riskiest and most complicated home loan product ever created." As the chart above suggests, such mortgages have become very popular; for example, the San Francisco Chronicle reports that the Bay Area alone has almost $31 billion of option ARMs waiting to reset. Nearly 20% of all home loans in the SF Bay area during 2004 – 2008 were option ARMS, and more than 27% of those loans are already "60-plus days delinquent or in foreclosure." In some nearby counties, the numbers are significantly worse.

Bottom line: bad as the sub-prime disaster was (it crashed major banks and investment firms, helped crash Fannie Mae and Freddie Mac – which were in essence taken over by the federal government – and kicked off a worldwide financial crash of historic proportions), the option ARM disaster will be worse – especially since the banks, the overall financial system, most businesses large and small, governments at local, state, and federal levels, and typical American families are in far worse shape than they were two years ago before the storm began. For instance, government revenue is down while demand for many government services – especially safety-net services, from food programs to unemployment benefits – is up. The result is predictable:

"Nationally, 35 states and Puerto Rico expect to have $56 billion less next year than they will need to pay for all of their programs, according to the National Conference of State Legislatures. In Nevada, Arizona and New Jersey, the difference amounts to more than one-quarter of their budgets, the conference said. Funds from the $787 billion federal stimulus bill passed in February run out at the end of next year."

Schwarzenegger Seeks Obama’s Help for Deficit Relief, Bloomberg.com, 12/24/09

That last sentence suggests the pain will continue into 2011 and beyond, and with the government using more of what caused our economic problems (over-spending, over-printing of money, over-regulation of the economy, etc.) to supposedly fix the problems, that seems a good bet.

Of all the things I read last night and today, perhaps this animated chart brings it home the hardest. It's the jobless rates by county over time dating back to January of 2007.

President Obama has taken the merest of baby steps on getting things back to right. He said it yesterday; sometimes we take a tumble on the road to recovery...here's hoping we get right back up and keep walking forward instead of lying in the ditch wating for the bus to hit us again.

Comments:

Order comments Newest to Oldest Refresh Comments

Comment by  velveeta jones on 01/09/2010 16:58:40

velveeta jones on 01/09/2010 16:58:40

Great blog. The animated chart is pretty darn amazing. It makes me sooo grateful to have the crappy job that I have.

Comment by  livingonli on 01/09/2010 17:24:45

livingonli on 01/09/2010 17:24:45

Hi folks.. Day started late today. It was a crazy night last night since I was doing the Devils game which had a power outage at the arena for over an hour and a half and the people working the Devils telecast managed to talk for over an hour and a half until the game was finally postponed. Good thing I was given a contingency because I had to change all the overnight programming as a result. I was pooped when I got home last night.

Comment by AuntAzalea on 01/09/2010 23:27:25

That was an excellent blog- I was just asking VJ this morning about the job market and how people are managing, it seems like the middle class has been invisible on the news lately- your posting all the colored charts really help show so plainly what years and years of deregulation has done. Thanks for another great blog!

Happy Saturday everyone.

Happy Saturday everyone.

Comment by  Scoopster on 01/10/2010 15:35:11

Scoopster on 01/10/2010 15:35:11

Gotta do it..  for Ahnuld on MTP this morning putting aside the partisan crap when asked about the recent airline security mess and talking with a sense of reality.

for Ahnuld on MTP this morning putting aside the partisan crap when asked about the recent airline security mess and talking with a sense of reality.