- About Us

- Search

- Need Help?

- Donate

- Login/Register

Latest Entries

Actions Menu

Blog Roll

- 4F Facebook Page

- Turn Up The Night with Kenny Pick

- Stephanie Miller Show

- The Tim Corrimal Show

- The Rachel Maddow Show

- Angry Americans with Paul Rieckhoff

- Thom Hartmann Program

- Turnips! Fans of Turn Up the Night Facebook Page

- Snopes.com

- Factcheck.org

- Official White House Page, if you must.

- The Brad Blog / Green News Report

- The Poorly Written Political Blog (Joe Santorsa)

They Won't Even Let Them Eat Cake.

Author: Raine

Date: 07/11/2011 12:54:10

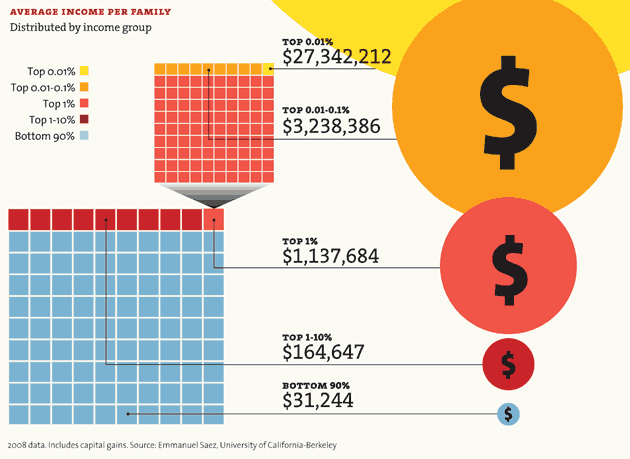

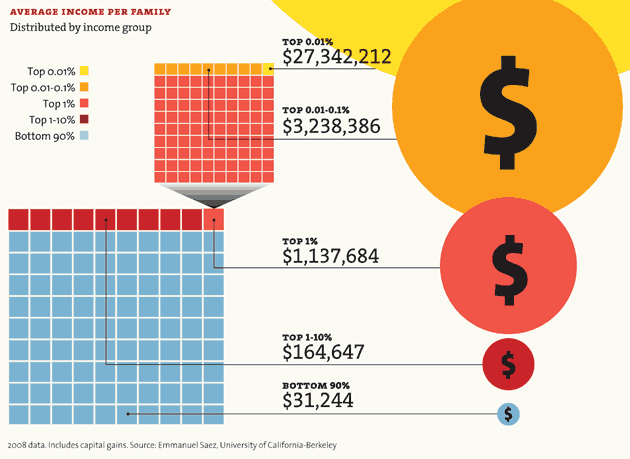

While the GOP fights to protect these people:

Source: Mother Jones

... It should be mentioned what the consequences of not raising the Debt Ceiling will be...

Good thing the GOP is hell bent on protecting the wealthiest of Americans from having to pay a little more in Taxes. This is what they want to do to America. They are so blinded by power that they are willing to let this country default on the bills it owes.

Something is very wrong here. For today, I don't know what else to say.

and

and

Raine

... It should be mentioned what the consequences of not raising the Debt Ceiling will be...

Cut $125 Billion Per Month - Right now, the federal government must borrow an additional $125 billion each month to finance all of its commitments. If the Treasury chooses to continue to pay creditors but stop all other federal spending, the government will have to begin reducing its spending by $125 billion every 30 days--mmediately. These cuts could affect everything from NASA and the FBI to congressional salaries and White House operating expenses.

Treasury Bonds Collapse - If the government defaults on its debt, economists say that prices for Treasury bonds would collapse and interest rates would probably soar to record highs. The centrist Democratic think tank Third Way estimates that the bond rate increases alone would eliminate nearly 650,000 jobs in the United States.

Cut Medicare and Social Security - To reduce spending by $125 billion a month, the government would have to make deep cuts to the two giant entitlement programs for the elderly, Medicare and Social Security.

Stock Market Plunge - Wall Street generally agrees with Geithner that it would be a disaster if the U.S. defaulted on its debt. In addition to damaging the nation's creditworthiness in global markets, most experts agree it would torpedo the stock market and very possibly trigger a double-dip recession.

Government Furloughs or Mass Layoffs - The federal government would most likely turn to furloughs or mass layoffs to immediately cut spending, possibly including the salaries earned by the approximately 2,000 people who work at the Bureau of Public Debt, the department that borrows the money to keep the federal government running. This could drain even more money from local economies and the states' tax bases.

Sky-High Mortgage and Interest Rates - If the government defaults, interest rates on mortgages would shoot up and homebuyers and small businesses would have trouble getting loans even if they could afford the higher interest.

Something is very wrong here. For today, I don't know what else to say.

Raine